After the pandemic hit, the federal government passed the CARES (Coronavirus Aid, Relief, and Economic Security) Act, which in part allowed mortgage holders to take a three-month break from making payments, since so many Americans had lost their jobs. The initial guidance from the government about the break, called forbearance, was that after the three months were up, the entire balance was due at once. The Finance Housing Federal Authority has now said that they will allow borrowers to modify these payments. What this means is that borrowers can either pay these deferred payments when they sell their property. add …

Read More »Ricchio named a top mortgage broker

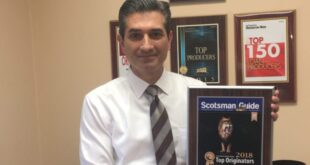

Ron Ricchio was among the top 50 mortgage brokers in the country last year in terms of total loan volume, according to Scottsman’s Guide, a national residential and commercial publication. The ranking places him at the pinnacle of a profession that includes thousands of brokers nationwide. Ricchio was ranked among the best mortgage lenders in 2018 by #BorrowWisely, the top 350 originators in the country in 2016 by National Mortgage News, and the top 200 originators in the country in 2010, 2011 and 2014 by Origination News. A broker since 1991, Ricchio is president of Chicagoland Home Mortgage Services in …

Read More »Will rates be low forever?

I started my career back in 1991, nearly 30 years ago, when rates were roughly around 10 percent. We have seen rates below 6 percent since 2001, and the current run of low rates is unprecedented in modern history. It’s been a good year for mortgages rates so far. Rates have been down as low as 3.99 percent recently for a 30-year fixed after being as high as 5 percent in November 2018. Then the housing market dwindled to a slow crawl, knocking rates back down again. The mortgage interest market is in a very strange and unique position right …

Read More »Underwriting guidelines begin to loosen up

Prior to the financial crisis in 2008, I would sometimes hear the phrase “If you can fog a mirror, you can get a mortgage,” meaning that if you were breathing, you would be approved. While that’s not true, there were a lot of people who shouldn’t have gotten a mortgage prior to 2008, when underwriting guidelines were most flexible. After the financial crisis, mortgage underwriting guidelines did a complete 180. They went from the easiest to the hardest that I had ever seen in my 28-year career. Fannie Mae and Freddie Mac had experienced almost $170 billion in losses and …

Read More »Buyer’s market may be on the comeback

Just a few short months ago, the 30-year fixed rate broke above 5 percent. Unemployment has been at a 50-year low, the U.S. consumer has been spending like there’s no tomorrow and wage inflation was at the top of the Fed range. All these were indications that mortgage rates were going to continue to march higher, possibly into the mid 5s. Then came the government shutdown, the threat of 200 billion in tariffs on China, and a 10 percent correction in the market in December, and rates in January came back down to the mid 4s. Mortgage rates play a …

Read More »New from Fannie Mae and Freddie Mac

Mortgage giants Fannie Mae and Freddie Mac have made buying single-family homes and small multi-unit residential properties easier with their new products: HomeReady from Fannie Mae and Home Possible from Freddie Mac. Buying a single-family home with each of these products can be done with as little as 3 percent down and the private mortgage insurance is priced as if you were putting down 10 percent, which makes the monthly payment lower. Also the minimum credit FICO score for these is down to 640, also allows borrowers who do not have perfect credit to use this product. The Freddie Mac …

Read More »How reverse mortgages works

When someone takes out a regular (forward) mortgage, the borrower makes monthly payments to pay the mortgage down. With a Reverse Mortgage, if you are approved there are no monthly payments and the mortgage balance instead goes up. Why would anyone what to get a reverse mortgage? First of all, not everybody can. It’s only available to borrowers who are 62 years of age or older. How much equity you can access is based on your age and how much your home is worth. It is very popular for seniors who have limited income and have very small mortgages …

Read More »Keeping rate increase at bay while you shop

With mortgage rate hitting their highest level in seven years, some lenders are coming out with products that are helping to keep rate increases at bay while the borrower is shopping. This feature is called “Lock and Shop,” and it’s as simple as its name. Usually a borrower cannot lock into a rate until they have selected a property and come to an agreement on a price. The Lock and Shop feature allows you to lock into an interest rate for 60-90 days while you are shopping for a home. Once you have found a home and your offer is …

Read More »The Loan Estimate: Your Shopping Tool

When shopping for a mortgage, the Loan Estimate is going to be your shopping tool. It’s a treasure trove that reveals a wide range of costs and other valuable information. The Loan Estimate or LE replaced the Good Faith Estimate or GFE a few years ago when the Fed put into place some new rules. The GFE showed the rates and closing cost but did not show other important aspects the loan. The LE is a 3-page document that clearly and simply shows the following: Loan Amount Interest Rate Monthly Payment Type of loan and amortization If there are …

Read More »Rates are still “movin’ on up”

The Fed raised rates a quarter point in March bringing the prime rate up to 4.75 percent. Fed Chairman Jerome Powell stated that the economy is doing well and that the increase is in line with the Fed expectations. The Fed has stated that they are expecting to increase rates a total of three times this year, at .25 percent each time, and two times in 2019. The unemployment rate in March ticked up to 4.1 percent from 4.0 percent, which is still historically low. Meanwhile, wage inflation remained tame, allowing the Fed to stay the course with its …

Read More » Fra Noi Embrace Your Inner Italian

Fra Noi Embrace Your Inner Italian